THE COVID-19 pandemic jolted the world out of its complacency, challenging ways of living and doing business, and testing the human mind and spirit to the limit. It not only brought hygiene and food safety to the fore, but, says Husky’s general manager: sales, Ashley Henry, amplified industry trends for more flexible operations supporting a wider variety of applications, more SKUs, shorter production runs and more frequent design changes.

‘Producers had to adapt rapidly to deliver new applications such as hand sanitiser, disinfectant and other health- and cleaning-related products,’ he explains. ‘The need for preform moulding solutions for a range of applications and production volumes was accentuated.

‘To stay competitive, producers had to be more flexible.’

Husky, he adds, has a platform of flexible moulding solutions. ‘For high volume, single SKU products, our HyPET HPP5e system delivers high productivity, quality and consistency for driving down total cost of ownership. For the mid-volume, multiple package market, our recently launched NexPET system’s flexible design is purpose-built for shorter production runs and frequent changeovers, without compromising performance quality.’

Few companies can claim to have emerged from 2020 unscathed, but MJH Machinery exited the year a happier camper than most, having experienced similar opportunities as in previous years. ‘We changed our marketing approach, which proved a great success, and employed a permanent salesperson in the Eastern Cape, who has made significant inroads into that market,’ explains partner, Ricky Lazenby. ‘Sinosia in Johannesburg kept our machines on its showroom floor for customer viewing. We also trained a robot technician to do installations and programming at customer sites.

‘We maintained our normal stock of three machine sizes, with more a few weeks away. Haixing, with which we have had a 17-year association, can turn out a machine ready for shipping within 21 days. This has made a huge difference to our larger machine sales.’

Although MJH’s technicians are able to resolve about 95% of customer issues, stocks of accessories and spares had to be kept at a level affordable to the company, without sacrificing customer support levels, Ricky adds.

For Ipex Machinery, the weakening rand was among the biggest disappointments of 2020, says managing director, Bruce Allen, as it made investment with European suppliers expensive. ‘Although opportunities arose in 2020 through sudden demand for “new” products, coping with this without having to make new investment resulted in high request for quotations, but low order update,’ he elaborates.

Skills levels remain a sticking point when the market needs rapid response and non-standard products. ‘Quality and repeatability are not issues for world leading machine builders. The challenge is skills among operators and those setting up machines.

‘Consequently, more machine manufacturers are offering remote service capabilities extending to remote visual assistance and process support,’ Bruce continues. ‘Leading manufacturers integrate remote glasses to support operators or technicians, ensuring that the manufacturer has “eyes” into the machine set-up and process.’

Given lockdown’s travel restrictions and social distancing protocols, ASB Nissei had to curb its natural tendency to spend time with customers, states general manager, Corné Pretorius. ‘We also struggled a little to achieve rapid turnaround time with spares supplies, but generally we met our customers’ expectations in a challenging year.’

The major trend he noted during 2020 was demand for low-output products from 300 to 200 bottles/hour across most industries served.

Disruption drives digitisation

Apart from the global economic implications, Covid made itself felt in homes far and wide, turning same-day home delivery, drive-up grocery services and other digital shopping from convenience into necessity. This spurred a surge in e-commerce that brought challenges and opportunities in equal measure.

It left no doubt that the future is digital and the future is now, and that digitisation is not an option, but the only option. Remaining competitive depends on it, in both manufacturing and transactions, says Ashley. And it will increasingly influence how technologies are designed.

Husky has a digitised next generation end-to-end manufacturing operating model to deliver solutions with unmatched speed and flexibility, he advises. ‘Hardware is configured through a web interface and then produced in a state-of-the-art laboratory using automation, enabling our customers to respond effectively to consumer demands by quickly introducing new products into the market.

‘Faster package redesign and speed to market for new products are key to gaining premium position and growing market share. Lower volume, shorter lifecycle products are becoming more popular. Producers will need not only to deliver more diverse food, beverage and consumer product options, but to create a truly efficient, circular economy for plastics.’

Pandemic spreads innovation

Into an arena in which normal is being reconfigured have come innovations such as Husky’s aforementioned NexPET system (pictured above), which, explains Ashley, is engineered for both established and emerging producers, better responding to evolving consumer preferences, while achieving the highest value, flexibility, reliability and sustainability. ‘For established producers, NexPET delivers an agile, reliable solution to accommodate niche brands or smaller run SKUs,’ he explains. ‘For emerging producers, it is a proven, cost-effective solution that enables fast, low-risk entry into markets.’

With sustainability top of mind, the trend is to put more post-consumer resin (PCR) into preforms, he continues. ‘As this resin is available in different grades, it is important to select the right equipment to process the material efficiently while maintaining quality. Husky has technologies that facilitate up to 100% PCR in preforms. Working with equipment that purifies the recycled material and eliminates the intermediate steps of pelletising and remelting, the system offers additional value in operational savings and material quality.’

Dissecting costs

Determining cost per part of a process is becoming increasingly important, Bruce stresses. ‘This means measuring not only energy input, capital investment cost and labour cost, but “drilling down” to predict and include maintenance costs in the calculations. Repeatability of quality and accuracy in machine control is vitally important to machine manufacturers, as it gives moulders a stable manufacturing process.’

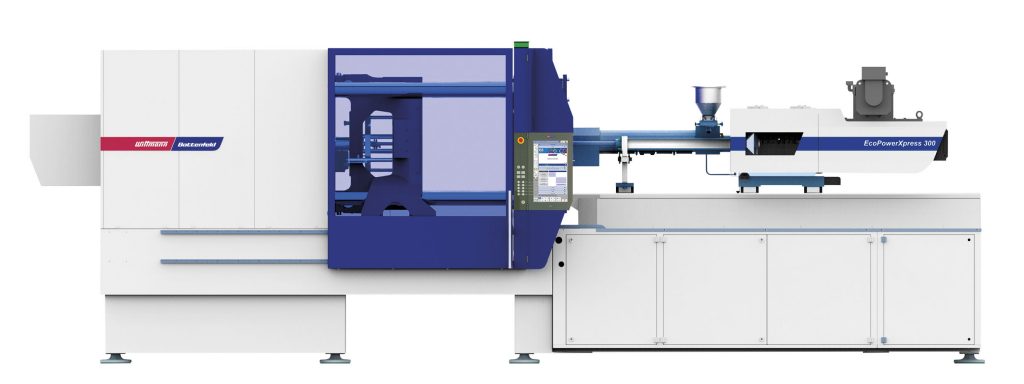

Ipex principal, Wittmann Battenfeld, constantly refines its machines in line with digital trends, says Bruce. ‘New models offer extremely low energy consumption, being fully integrated in a single work cell – all components of the injection moulding process communicate with each other seamlessly and share and analyse manufacturing data in the Industry 4.0 interface. Process monitoring and “on the fly” process optimisation ensure consistent quality of the manufacturer’s product.’

Nissei ASB is increasing its customers’ productivity with its Zero Cooling innovation, says Corné. ‘We are applying the technology to all models in our four-station, one-step ASB Series line-up, which is boosting productivity between 20% and 60% depending on container design, while achieving increased physical strength of up to 15%, with enhanced visual quality.

The company’s new models also boast multilayer solutions.

Haixing’s recent enhancements include injection unit linear guides and manufacture of stronger, slightly bigger and speedier machines, according to Ricky.

The year ahead

Bruce predicts that the market will stabilise in 2021. ‘In all things, equilibrium is sought,’ he states. ‘We believe that customers will return to normal buying patterns where equipment quality and performance are measured against price. Price performance ratio should always be the underlying decision in capital equipment investment.

‘In South Africa, however, cheap is often chosen without consideration of the “costs” inherent in a light price tag. That said, no manufacturer can charge higher prices just because of a brand – there has to be a measurable payback in performance, operation cost and service.’

Consumers will look at packaging with increasingly Covid-cautious eyes, Ashley predicts. ‘With the virus still prevalent, consumers are opting for safe packaging options such as PET bottles, whose drinking surfaces are not exposed to airborne contaminants.

‘Products are sitting on shelves for longer and are being packaged in smaller sizes for sale in multipacks. The goal is to keep the product preserved to point of consumption. We are certain to see more focus on prolonging shelf life using technologies such as mutilayer preforms, particularly for dairy and small-format carbonated soft drinks.’

Ricky is confident of MJH’s prospects. ‘I expect 2021 to be a great year,’ he comments.

The POLYOAK PERSPECTIVE

THE use of recycled polyolefins for food applications needs more thought, says Karl Lambrecht, chief executive for Dairypack Tubs, Polyoak’s injection-moulding division. ‘In-mould labels on injection moulded tubs continue to be a sustainability winner, as seen by Dairypack’s Gold Pack-winning Danone yoghurt tub range. These tubs are an important contributor to the circular economy, being lightweight, widely recycled and frequently reused beyond their original purpose.’

As a founding member of the SA Plastics Pact, Polyoak never loses sight of its 100% recyclable packaging goal.

‘The recycling rate of our HDPE beverage bottles is already the highest in the country, at 75% compared to lower than 14% for cartons,’ says executive: marketing and sustainability, Michelle Penlington. ‘So, although it’s not possible to include recycled HDPE in food contact packaging, HDPE beverage bottles create the feedstocks required to manufacture recycled bottles for detergents and personal care products such as shampoos. It’s proper systems thinking!’

Polyoak is working on several exciting products against the backdrop of its target of 30% recycled content in its packaging by 2025, she adds.

Short, speedy, cool performer

ENGEL’S large-scale duo speed injection moulding machines – designed with higher clamping forces of 5 000 to 11 000kN on both the clamping and injection unit sides – are aimed at manufacturers of buckets, storage and transport containers.

‘Across all clamping force sizes, the duo speed is shorter than comparable dual-platen injection moulding machines used in this type of application,’ reports Christoph Lhota, VP of the Packaging Business Unit. ‘It is also the fastest, thanks to shortened cycle times, including drying cycles of between 2.35 and 3.4 seconds.

‘The short cycle times are achieved through a fast clamping mechanism and perfectly matched plasticising and injection unit. Improved power control increases screw speed while enhanced barrel cooling betters intake performance.’

Christoph adds that precise clamping force distribution and platen parallelism control guarantee fewer rejects and the highest possible quality. Additionally, Smart ENGEL iQ assistance systems from the inject 4.0 programme ensure process stability.

Energy efficiency the Engel way

According to Engel, the exposed tie-bars provide a clean mould area and high energy-efficiency levels.

The OEM lists other energy-saving features as Ecodrive servo-hydraulics (with operating point optimisation); optimised heating zones and accumulators, which support demand-driven charging of the accumulators and speed up the injection process; and an electric motor-driven screw drive that also lowers water consumption.

The duo speed also features as standard equipment a barrier screw and sliding ring non-return valve – optimised for polypropylene and high-density polyethylene.

‘This portfolio extension positions Engel to optimally leverage all efficiency and quality potentials, from thin-walled packaging, caps and closures to thick-walled large containers, with a perfectly-matched solution in each case,’ Christoph asserts.

Engel’s other injection moulding machines for packaging industry applications are the e-cap and e-speed series.

Ed’s note: Engel is represented in South Africa by Greentech Plastics Machinery.

Dedicated pre-owned machine division

Besides injection moulding machines, Engel Used Machinery will buy back used robots from the Engel series, refurbish the products and put them back on the market for sale.

‘In some cases, a second-hand production cell is the only option,’ says Dr Christoph Steger, CSO of the Engel Group, explaining this strategic decision. ‘We want to offer customers a high-quality solution for this requirement, with Engel’s customary consulting expertise and outstanding service.’

The newly-founded company is headquartered in Prague, Czech Republic, because eastern Europe is the largest and fastest-growing market for pre-owned injection moulding machines, reports GM, Leopold Praher (pictured below).

The repurchased injection moulding machines and robots are reconditioned in-house at production plants in Austria and the Czech Republic.